In the previous blog in this series, I investigated socio-economic differences in young people’s financial skills. This focused upon the types of financial questions that young people from advantaged backgrounds can successfully answer, that their peers from disadvantaged backgrounds can’t.

In this next blog, I start to consider socio-economic differences in one of the key inputs into the development of young people’s financial skills – the role of their parents. Are there certain things that higher-income parents do with their offspring to nurture their financial skills, that lower-income parents do not?

Let’s take a look (with further details available in the academic paper here).

Differences in knowledge

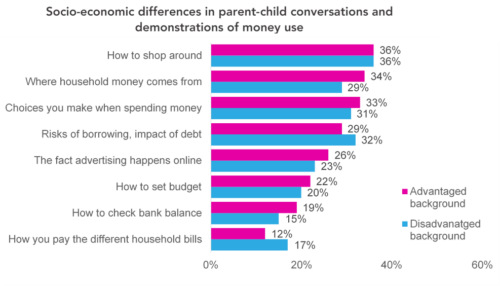

The chart below presents the percentage of parents who say they do various financial activities “often” with their children, divided by socio-economic group.[1]

Although higher socio-economic parents are slightly more likely to regularly do most of the activities with their offspring, differences are generally quite small. For instance, although high socio-economic status parents are more likely to talk to their child about where their household money comes from than low socio-economic status parents (34% versus 29%) and the fact that advertising happens online (26% versus 23%) there is no difference in – for instance – showing their child how to shop around.

There are also certain areas that lower socio-economic status parents are more likely to talk to their children about, such as the risks of borrowing, impact of debt and how they pay for different household bills.

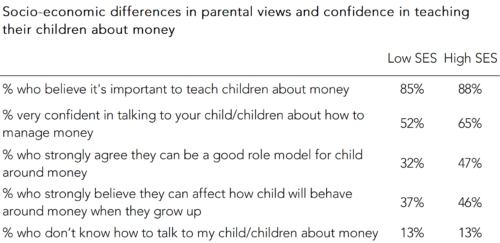

So, on the whole, socio-economic differences in the informal types of financial education parents provide their children are relatively muted. This point is reiterated by another finding from the survey – that the vast majority of parents recognise the importance of teaching their children about money, regardless of socio-economic background, as shown in the table below.

Where there does seem to be a notable socio-economic difference, however, is in parents’ confidence to be able to effectively teach their children about money.

For instance, more affluent parents tend to have greater confidence in being about to teach their child about how to manage money (65% versus 52%), that they can act as a good financial role model (65% versus 52%) and that they will be able to affect how their child will behave with money in the long-term (46% versus 37%), than disadvantaged parents.

Now, such differences could either reflect that (a) higher socio-economic parents are indeed able to teach their children about money more effectively or (b) they are simply more confident in doing so.

Either way, any socio-economic gap in financial skills does not seem likely to be linked to the frequency high- and low-income parents interact with their children about money – as they report having money conversations and conducting money demonstrations equally regularly. Rather, it seems more likely to be related to their ability to provide effective financial education to their offspring, either through a lack of skills or in lacking confidence to do so.

[1] Figures refer to percentage of parents who report that they “often” talk to or who show their child how to do the following things with money.

Leave A Comment